Are taxes in Italy too high?

Revenue Statistics 2018, a recent survey carried out by the international Organisation for Economic Co-operation and Development, reveals that there are more overburden countries among the 34 belonging to the OECD area than the bel paese.

Taxes have been classified by the base of the following taxes: personal income tax, corporate income tax, social security contributions, property taxes, taxes on goods and services, other. Restults show that, despite being in sixth place, the tax burden in Italy is slowly decreasing registering -0.2 points. It dropped from 42.6% in 2016 to 42.4% in 2017.

Considering the complete grid of countries, on top of the most overtaxed countries stands France with the highest rate: it has a tax level of 46.2%. So it may not be a coincidence that, in recent weeks, France has seen protests by the so-called “yellow vests” who are fighting against the fuel tax hike and to improve the spending power for the French people.

Denmark, which had the highest tax-to-GDP ratio of OECD countries from 2002 to 2016, had the second-highest tax-to-GDP ratio in 2017 (46.0%). Mexico had the lowest (16.2%).

Denmark is followed by Belgium (44.6%) in third position, Sweden (44%) and Finland (43.3%). At sixth place in fact, comes Italy (42.4%). Germany is 14th (37.5%), with the US toward the bottom of the ranking scale with 27.1%.

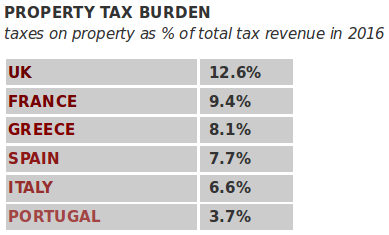

And what about the tax rate on real estate in Italy? It weighs in at 6.6% which is the lowest rate compared to that of other Mediterranean countries and UK. The only exception is represented by Portugal: